By Kent E. Fillinger

The COVID-19 pandemic has dominated our time and attention for much of 2020. This month’s article provides an overview of church finances based on our 2019 survey of 439 churches, while next month’s article will share findings from a separate survey that seeks to determine the impact of COVID-19 on the financial health of our churches.

How Much Money Was Given to Churches Last Year?

The total amount given last year to the churches we surveyed was $872,134,383. This included giving to the general fund, capital campaigns, building funds, and other sources. This reflected less than a 1 percent increase (0.7 percent) from the 2018 giving total. But average giving per church dipped 5 percent compared with 2018.

Did Church Giving Meet, Exceed, or Fall Short of the Budget Last Year?

Overall, 44 percent of churches said their total giving in 2019 exceeded their budget. Among large churches, 55 percent saw giving exceed budget—best among the six church size categories—while only 31 percent of very small churches saw giving exceed budget, the worst percentage among the various categories.

Giving fell short of budget at 30 percent of churches, ranging from a high of 36 percent at emerging megachurches to a low of 20 percent at large churches.

Twenty-six percent of the churches overall met budget last year. Very small churches were the most likely to meet their budget last year with 38 percent doing so. Emerging megachurches had the smallest percentage of churches meet budget last year with 13 percent.

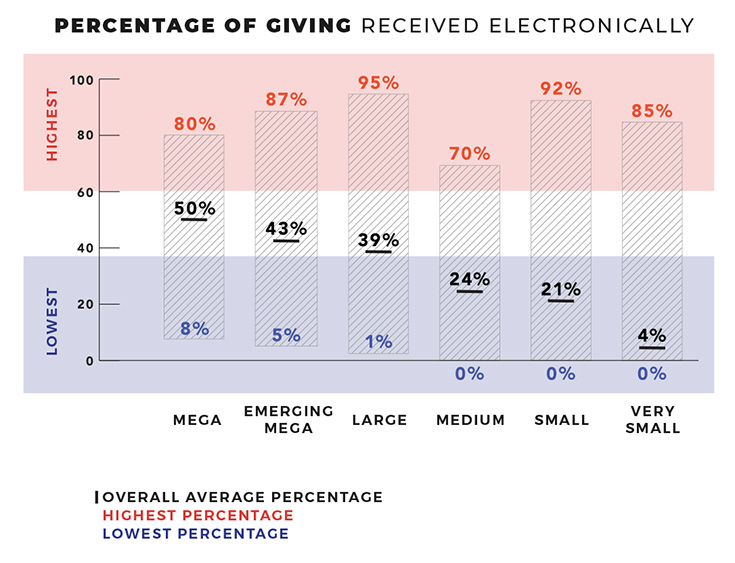

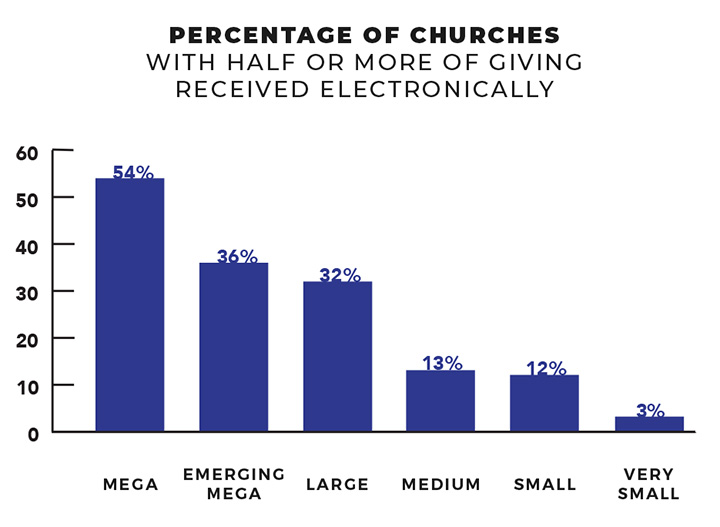

What Percentage of Total Annual Giving Was Received Electronically?

This was a new question in the 2019 church survey—and the percentages surely have climbed during COVID-19 (more on that in next month’s column).

In 2019, the larger the church, the more likely it was to receive gifts electronically (i.e., online, via church app, text to give, kiosk, etc.).

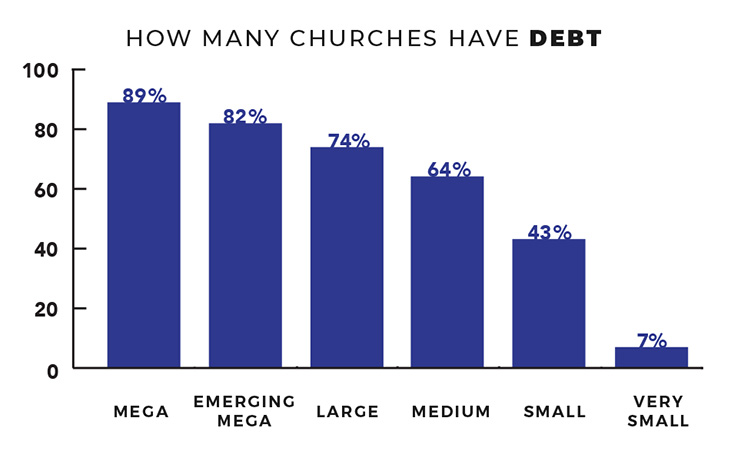

How Many Churches Have Debt?

Sixty percent of churches in our 2019 survey reported having debt. This was a slight decrease from 2018 when 62 percent of surveyed churches reported some debt. The percentage of churches with debt decreased in every size category except for small churches, where it increased by 2 percent.

The larger the church, the more likely it was to carry debt. The total debt reported for all churches last year was over $813 million. But the average debt load decreased in every size category last year except for megachurches and large churches.

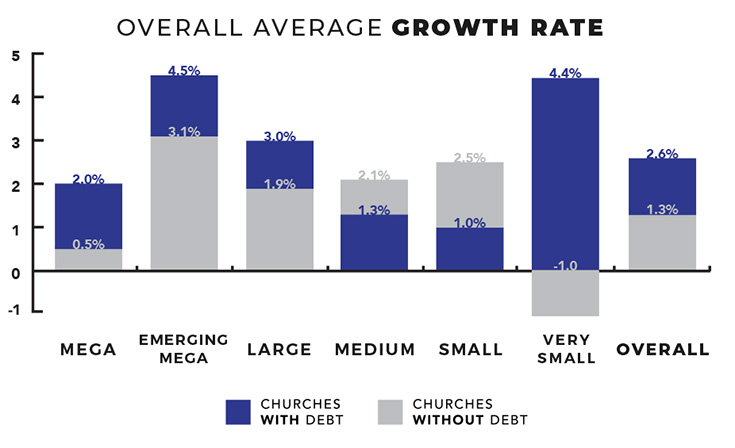

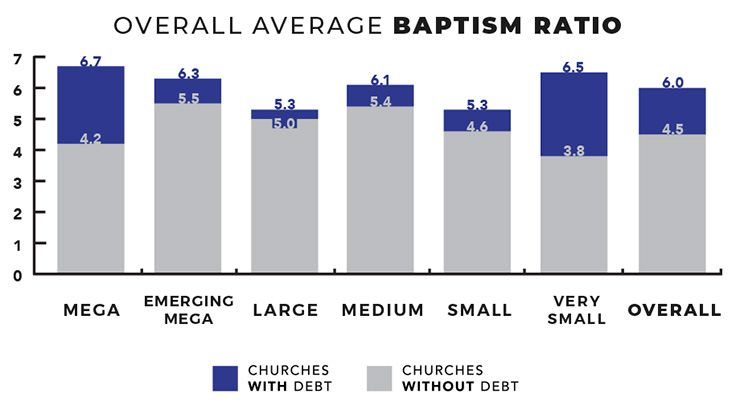

Does Debt Help or Hinder a Church?

A year ago, I studied our 2018 statistical data and learned churches that carried debt were more likely to grow faster and baptize more people than churches with no debt. (Read more in my September 2019 article “The Debt Debate,” available at Christian Standard’s website.)

The data from our 2019 church survey reinforced the fact that most faster-growing churches, and most churches baptizing a higher percentage of people, also had some level of debt.

The chart indicates that, in all but two size categories, churches with debt had better growth rates and baptism ratios (number of baptisms per 100 in average weekly worship attendance). Overall, churches with debt grew twice as fast as churches with no debt in 2019.

I would contend that a healthy, strategic amount of debt can signify a church is moving forward in faith and is willing to take reasonable financial risks to reach the lost.

How Many Weeks of Cash on Hand Do Churches Maintain?

Christian Financial Resources CEO Darren Key often says the one financial number every church needs to know is the weeks of cash on hand. He says failure to maintain adequate cash reserves can lead to disaster for a church. The recent pandemic is a perfect reminder that you never know when the economy could struggle or a natural disaster might occur, thus creating a financial burden for your church. Key suggests 13 weeks of cash on hand is the minimum target for a church.

A simple method for calculating total cash on hand is to divide your church’s annual expenses by 52 weeks to determine your weekly cash need. Then add up all your cash—in checking, savings, and other “liquid” accounts—and divide by the weekly cash need to find your weeks of cash on hand.

Overall, churches that participated in our 2019 research survey averaged 10 weeks of cash on hand, slightly better than the 9.8 weeks of cash on hand from 2018. Again in 2019, very small churches had the most weeks of cash on hand (12.8 weeks). Emerging megachurches, large churches, and small churches tied for the lowest level of cash reserves (9.1 weeks). Rounding out the data, medium churches averaged 10.2 weeks of cash on hand while megachurches averaged 9.4 weeks.

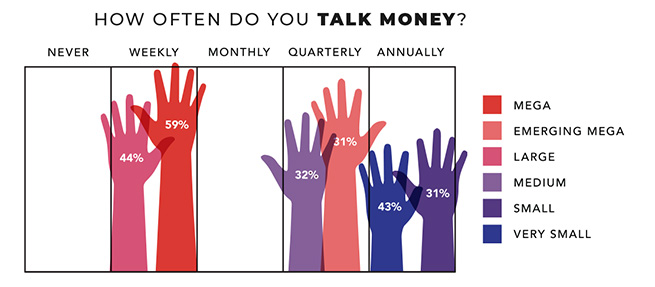

How Often Do Churches Talk about Giving, Generosity, or Stewardship During Weekend Services?

This was the first time we asked this question of churches in our annual survey. The answer options included never, weekly, monthly, quarterly, or annually.

One-third of the churches (33 percent) reported talking about giving on a weekly basis. The second most common response was annually (27 percent), followed by quarterly (23 percent). Only 2 percent of the churches said they never talk about stewardship.

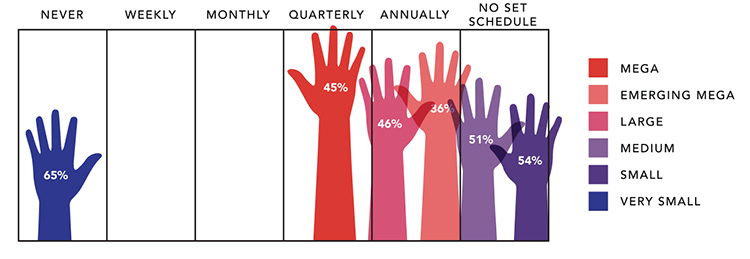

How Often Do Churches Offer Money Management Classes?

This was another new question for 2019. Answer options included never, weekly, monthly, quarterly, annually, or occasionally/no set schedule.

More than one-third of the churches (36 percent) reported offering money management classes occasionally or with no set schedule. This was the most popular response regardless of church size. Thirty-one percent of churches said they offer money management classes annually, while 16 percent offer them quarterly. Fifteen percent of churches said they never offer money management classes.

Kent E. Fillinger serves as president of 3:STRANDS Consulting, Indianapolis, Indiana, and regional vice president (Ohio, Pennsylvania, Michigan) with Christian Financial Resources.

0 Comments